Real estate definitely comes with it’s fair share of risks…however so does everything that is worth having!

When it comes to financial freedom, there is not a single asset class that will set both you and your family up like real estate can if you focus your investing strategy on:

- Buying for cashflow 💵

- Adding value to your properties to build equity to then redeploy for other properties or assets 🛠️🏠

- Developing systems & processes to make your growing portfolio easier to manage over time 🔁

1. The Unshakable Foundation: Real Estate’s Resilience

Real estate isn’t just about square footage; it’s about the space it occupies in your financial journey. Here’s why it’s more than just bricks and mortar:

- Tangible Security:

- Unlike elusive stocks or digital currencies, real estate stands firm—a tangible asset you can touch, walk through, and call your own.

- It’s the oak tree you plant today, knowing it’ll provide shade for generations to come.

- Cash Flow Symphony:

- Buy properties for cash flow—the sweet sound of rent checks hitting your account.

- Positive cash flow means financial harmony: income exceeding expenses. It’s like composing a money sonata.

- Appreciation Overture:

- Real estate appreciates over time. Sure, there are short-term variations, but historical data sings a steady tune.

- As cities grow, demand for housing crescendos, lifting property values. Your investment hums along.

2. Strategic Notes: Building Wealth Chords

Let’s fine-tune your investment symphony:

- Buying for Cash Flow:

- Seek properties in thriving areas. Research local markets, vacancy rates, and rental trends.

- Positive cash flow means tenants pay your mortgage while you sip coffee by the fireplace.

- Adding Value Crescendo:

- Embrace fixer-uppers. Renovate wisely—kitchens, fresh paint, curb appeal.

- Equity blooms as you transform a plain canvas into a masterpiece.

- Leverage Harmony:

- Real estate lets you dance with leverage. Put down a fraction, borrow the rest.

- If the property appreciates, your gains waltz to the rhythm of the entire value.

3. Systems and Encore: Scaling Your Portfolio

- Property Management Sonata:

- As your portfolio swells, systems matter. Automate rent collection, maintenance, and leases.

- Property management software? It’s your conductor’s baton.

- Diversification Symphony: Beyond Residential:

- Explore commercial real estate, vacation rentals, land development.

- Diversify like a skilled pianist—different notes, same beautiful melody.

4. The Emotional Coda: Pride and Legacy

- Pride of Ownership Aria:

- Owning real estate is like conducting a symphony. You’re not just an investor; you’re a curator.

- Imagine telling your grandkids about that charming apartment building—the legacy you composed.

- Generational Encore:

- Real estate creates generational wealth. Pass it down like a cherished violin.

- It’s not just about today; it’s about the echoes of your choices in the future.

📊Data & Trends To Note!

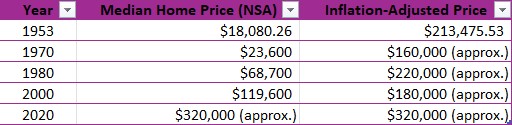

Home Values Over Time: A Journey Through the Decades

Let’s step into our time machine and explore the median home prices in the United States from the mid-20th century until today. These figures reflect existing single-family home sales:

Could you imagine how ridiculous it looks for multifamily or even commercial properties now?! 🤯

Existing-Home Sales (May 2024):

- Sales dipped slightly, but fear not! The median prices hit a record high 📈

- Imagine it: The real estate market hums along, and you—the astute investor—are still cheering from the balcony

Pending Home Sales (May 2024):

- A 2.1% slip—a graceful sidestep, like a rogue avoiding a trap.

- But wait! The Northeast and West spun with gains, defying gravity.

- Year-over-year, all regions moved in unison toward reductions—a synchronized shift of numbers.

Conclusion: Your Real Estate Quest Begins

I hope to have convinced you just how vital it will be for you and your families wellbeing to start earning and saving more in order to claim your fortress and plot of land! 🏢

⭐Save Up Like a Squirrel: Just as squirrels stash acorns for winter, save diligently for your down payment. Every dollar counts—whether it’s from skipping that extra latte or negotiating with the local dragon.

⭐Market Timing Is for Gamblers (and They’re Not Great at It):Resist the urge to time the market. Even the most talented and experienced investors struggle with predicting real estate trends. Instead, focus on long-term growth. Your commitment is your greatest tool.

⭐First-Time Buyer Programs: Your Sea of Opportunity:

- FHA Insured Loan: Low credit score? No problem!

- VA Loan: A military benefit for our brave warriors (0% down payments!)

- Conventional 97 Mortgage: A mere 3% down payment.

- HomeReady Loan: A 30-year fixed-rate .

- Home Possible Loan: Flexible mortgage terms for those with not the strong finances to get lower down payments and the option to cancel mortgage insurance after reaching the ~20% home equity threshold (can vary by lender)